Hi everyone in recent months, interest in crypto has grown, accomplices to some tweet of Musk and NFTs, who have pushed many to approach this world. I have always been fascinated by this world that in some ways I consider the future of finance, I have deepened it over time and I wanted to share here a list of essential terms to start on the right foot. The terms are in alphabetical order and not of importance, to facilitate the search.

51% Attack

It is a hypothetical scenario that could occur when 51% of the nodes of a blockchain are under the control of a single entity. In this case, the network consensus would not be distributed enough, because there would be a majority, and the blockchain could be manipulated. The aforementioned entity could arbitrarily block, reverse or duplicate transactions by invalidating the blockchain itself. This attack is as difficult as the blockchain grows in several nodes, values, and usage.

Address

An address in a blockchain is a unique string made up of letters and numbers that identify an account within the blockchain itself. During a transaction, digital assets, often called tokens, are moved between two addresses of the same blockchain.

Altcoin

Altcoins, or "alternative coins", are all cryptocurrencies that were launched after Bitcoin, some examples are for example ETH, LTC, XRP.

Annual Percentage Rate (APR)

An annual percentage rate (APR) on a loan is the amount of interest a borrower has to pay on the loan he has taken out. APR is expressed as an annual percentage of the outstanding loan balance and represents the annual cost of the loan.

Annual Percentage Yield (APY)

The annual percentage yield (APY) refers to the rate of return earned on a deposit in a year, therefore it translates into the sum that is earned by a person who has deposited funds and left to mature for one year. APY takes into account compound interest, which is calculated periodically and added to the balance.

Bitcoin & BTC

Bitcoin is the first and best-known blockchain worldwide and has its own native cryptocurrency (bitcoin). It is, historically, the first blockchain with associated cryptocurrency, and has always been a dominant presence within the cryptocurrency ecosystem. Bitcoin was founded in 2009, by Satoshi Nakamoto, and is based on the Proof of Work algorithm, a technology for reaching consensus on a decentralized network.

Bitcoin (BTC) is a cryptocurrency that can be transmitted between accounts on the Bitcoin blockchain by exchanging assets between two addresses.

The difference between Bitcoin as a blockchain and bitcoin as a cryptocurrency is in the initial B which in the first case is capitalized, in the second it is lowercase.

Block

Within a blockchain, a block is a single entity that makes up a piece of the chain. Inside, all the information on the transactions carried out (the exchange of tokens/coins between addresses of the blockchain) during a predefined time interval depends on the blockchain itself. The blocks are hung one after the other at the end of the chain, which represents the public ledger known as the blockchain.

A Bitcoin block contains information on the date, time, and amount of transactions, including all information about the addresses involved and the amount of currency they exchanged. The blocks must all be confirmed by the nodes of the network through a process of consent, once the block is confirmed it is added to the end of the chain and the chain can move on to the creation of the next one.

Blockchain

A blockchain is a public register of transactions that is maintained and verified by a decentralized network of peer-to-peer nodes/computers which, thanks to a consensus mechanism, confirms the data.

A sufficiently decentralized blockchain makes it possible to exchange cryptocurrencies to carry out transactions in a secure, verifiable, and rapid way, without authority or centralized intermediaries globally.

Each computer on the network keeps a copy of the entire ledger, making it virtually impossible for a single node to alter past transactions or overwhelm the network.

Block Explorer

A block explorer is a software that allows users to access all the operating information of a blockchain in real-time: transactions, blocks, addresses, nodes, and balances. Many of these interfaces are available via web browsers, are free, open source, and essential for providing transparency and democratized access to the blockchain network.

Cold Wallet

A Cold Wallet is a cryptocurrency wallet that is not connected to the Internet, very often they come in the form of physical devices that store private keys and are used to "keep your cryptocurrencies safe". Very similar by analogy to hard drives for backups not directly connected to a PC or network.

Collateral

Collateral refers to an asset that is offered as collateral for the repayment of a loan. In the event that an individual is unable to repay the borrowed principal, the collateral will be held by the lender.

When borrowing money on a lending platform, collateral is often expressed in the form of tokens which are blocked by the platform itself. The guarantee is returned when the loan is repaid. If the loan is not repaid, the guarantee remains blocked on the platform and is no longer available to the loan applicant.

Cryptocurrency

Cryptocurrency is a digital asset that can be exchanged between two parties and that uses the internet for its circulation. Cryptocurrencies use blockchain as a distributed ledger of transactions that has inherent characteristics of transparency and advanced cryptography. The exchange of these assets or cryptocurrencies through the blockchain allows the certainty that they cannot be spent twice even in the absence of a centralized intermediary. The first cryptocurrency to achieve mainstream success was bitcoin followed in the following years by many other cryptocurrencies, often called altcoins.

Cryptocurrency Exchange

Cryptocurrency exchanges are similar to traditional exchanges where digital assets can be bought, sold, and exchanged for fiat currency (Dollar, Euro, Pound, etc...) or other digital assets, for example, they make direct exchange between two different cryptocurrencies possible.

Compared to the early years, when transactions were often unregulated, exchanges have evolved greatly to ensure transparency, accessibility, and legal compliance in the countries in which they operate. To compete in user numbers and trading volume they offer competitive trading fees, exchange rates, and user-friendly features.

Cryptomining

Cryptocurrency mining is the process by which, through solving complex equations, a blockchain with the Proof-of-Work consensus mechanism verifies transactions and adds new blocks to the blockchain. The computers that perform these mathematical operations are called nodes and the process by which they solve equations is called mining. For their efforts, the owners of these nodes, also called miners, are rewarded with a fraction of the blockchain's native cryptocurrency.

Decentralized Applications (dApps)

Decentralized applications -dApps- leverage the blockchain to offer services ranging from investments to loans, games, and governance. From a graphic point of view, they are very similar to web applications but the back-end processes do not use centralized servers to carry out transactions but implement them in a distributed and peer-to-peer way, often interacting with automated smart contracts on networks such as Ethereum.

Decentralized Finance (DeFi)

Decentralized Finance (DeFi) is a very growing sector in the blockchain landscape, offering financial services and technologies based on Ethereum. DeFi exchanges, loans, investments, and tokens are much more transparent, do not need centralized authorization, and are interoperable compared to traditional financial services, governance is decentralized and promotes fair stakeholder ownership.

ERC-20

The ERC-20 standard represents the set of technical specifications that an Ethereum token (often a cryptocurrency) must have to be fully compatible with the Ethereum blockchain. Through this standard, tokenized assets, tokens, or contracts can be created that can be bought, sold, and traded together with cryptocurrencies such as bitcoin (BTC) and ether (ETH) and used interoperably between Ethereum-based dApps.

Ethereum & ETH

Ethereum was launched in 2015 as a decentralized global network based on its own blockchain that forms the basis of an ecosystem of decentralized applications (dApps) that leverage tokens and automated smart contracts.

The blockchain's native token called Ether (ETH) is used to power the network. Ether plays a vital role in the Ethereum ecosystem, where transactions are paid for through micro-payments of ETH called gas.

All contracts on the Ethereum network are intelligent and self-executing, this means that there is no need for a central authority or an intermediary to control its operation. Ethereum, which by its nature is open-source, programmable, private, and resistant to censorship, forms the backbone of a decentralized Internet, where there are already many innovations such as Initial Coin Offerings (ICOs), Stablecoins, and decentralized finance applications.

Fiat Currency

A fiat currency is a government-issued currency of a state that is used by its citizens as a bargaining chip to buy goods and services within their nation. Most modern national or multi-country currencies, such as the Dollar or Euro, are fiat currencies.

Their face value is defined by the government or entity that issued it, they are not backed by a physical commodity (such as gold and silver) and to operate properly they must be durable, wearable, uniform, and limited.

Fork

A fork occurs when a blockchain splits into two branches or two different blockchains when an update occurs in the blockchain management protocol in which not all nodes decide to adapt to the update. The fork can be "soft" or "hard", in the first case the update is backward compatible with previous versions of the blockchain, the updated and non-updated nodes can still operate with each other, in the case of a "hard" fork this what cannot happen and the two blockchains become two distinct entities with a life of their own.

Gas

Gas refers to the fees associated with transactions and the execution of contracts on the Ethereum blockchain. Decentralized applications (dApps) take advantage of smart contracts in which rules are defined for the events' execution. These events are associated with transactions that have costs based on the actions they contain, the computing power, and the time required for their execution.

The gas is used to allocate the resources of the miners' network that support the blockchain, it is also used for spam mitigation because it discourages malicious actors who could send many small transactions to clog the network, having a price to pay to be able to do them, they are discouraged from doing so.

Halving

When the reward given to miners on a blockchain is reduced by 50%, a halving is said to have occurred. These halving events occur at fixed intervals and their scheduling is defined within the protocol of the blockchain itself. In the case of Bitcoin, halving occurs every 210,000 blocks generated, approximately every 4 years.

Hash Rate

Within a blockchain with a Proof-of-Work consensus mechanism, the hash rate identifies the unit of measurement of the computing power of a single node, generally, it is evaluated in terahash per second (TH/s) or its submultiples, as miners increase or decrease within the network the hash rate changes accordingly.

HODL

"Hodl" is a slang term that refers to keeping cryptocurrencies in a wallet as opposed to selling. Everything was born from an error of a user on Bitcointalk who wrongly wrote the word "hold", which was later transformed into a meme by the community.

Initial Coin Offering (ICO)

Sometimes to finance a new blockchain project, a decentralized application (dApps), or digital assets, Initial Coin Offers or tokens are launched to raise funds, made possible by the Ethereum blockchain. These sales are called ICOs and the ownership of these tokens allows the user to have an economic return or benefit in the project. In fact, this mechanism is very similar to the purchase of shares of a company but it is all managed in a decentralized way on the Ethereum blockchain.

Liquidity Pool

A liquidity pool is crowdsourcing of cryptocurrencies that have been locked into a contract used to facilitate and speed up the exchange of assets or coins on a decentralized exchange.

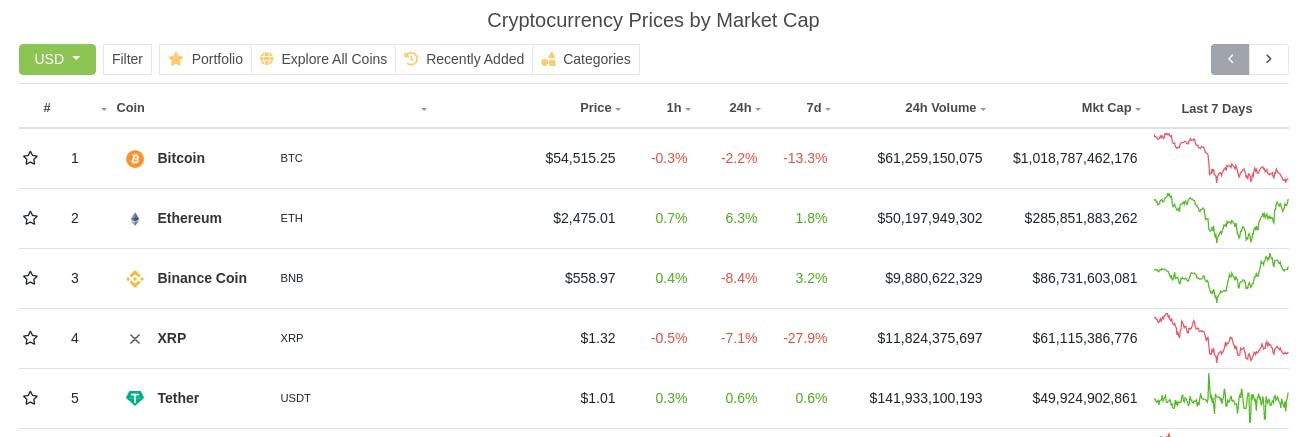

Market Capitalization

Market capitalization is the total value of all tokens of a cryptocurrency. This value is obtained by multiplying the total number of coins or tokens in circulation by the unit value of a single token in a fiat currency, for example, to date, the market capitalization of BTC is approximately 1,021,263,394,654 USD.

Miner

Miners are an essential component of all blockchains based on the Proof-of-Work (PoW) consensus protocol, they are responsible for validating the transactions carried out and registering them in a new block. To validate the transactions they have to solve complex mathematical problems, their resolution leads to the creation of new tokens, simultaneously increasing the security and reliability of the network. To incentivize users to provide computing power to perform these complex computations, miners are rewarded with a fraction of the blockchain's native currency with each new block created.

Mining and Mining Pool

Mining is the process whereby a computer, or generically a node, provides its computing power to the blockchain so that transactions are validated and new blocks can be produced in all those blockchains that use Proof-of-Work (PoW). During the mining process the miners, node managers, are rewarded with the native coin or token of the blockchain.

To increase the chances of mining a block of transactions, miners merge into what is called a mining pool to combine individual computing power. In the case of extraction of a block, the reward is divided proportionally on the basis of the participation of each.

Non-Fungible Token (NFT)

A non-fungible token (NFT) is a special type of token that represents a unique digital asset that cannot be exchanged for another type of digital asset or split into smaller pieces. This feature makes it different from other types of tokens or cryptocurrencies on the Bitcoin or Ethereum blockchains which are fungible.

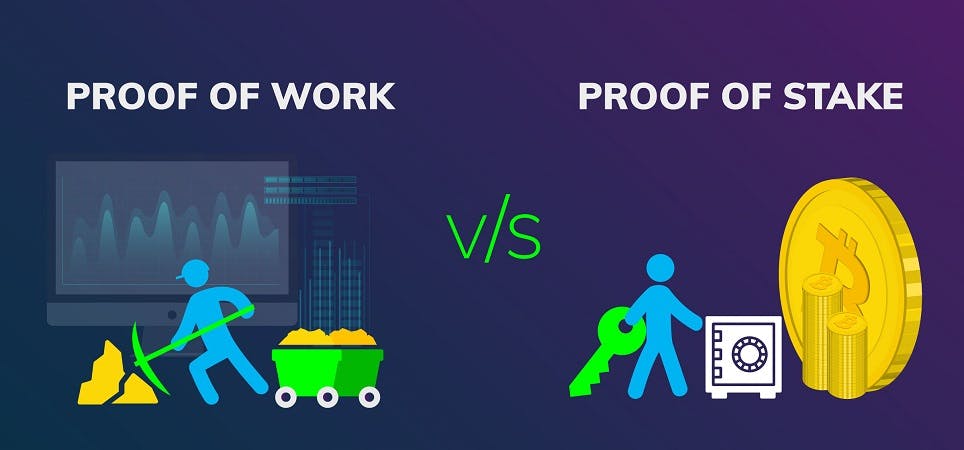

Proof of Stake

The Proof of Stake (PoS) consensus mechanism is one of the most widely used mechanisms today for validating transactions on a blockchain that differs from Proof-of-Work.

In the Proof of Stake, nodes participate democratically in the validation of transactions as the participants point to the native tokens of the network and randomly, in proportion to the number of tokens staked, they are chosen to validate the data of the block, thus generating the next block and earning native tokens as a reward.

Such a network offers greater security, resilience, and computing power, and also allows the creation of decentralized governance of the platform by voting on updates and decisions. PoS networks are proving to be faster and more scalable than blockchains and more energy efficient.

Proof of Work

Proof of Work (PoW) is a consensus mechanism first brought to the fore by the Bitcoin blockchain. This type of mechanism relies on the concept of mining to maintain the network. The miners provide their own computing power that is required to solve complex mathematical problems, these calculations are necessary for the confirmation of the data present in the transactions, as a reward in the case of a correct solution, miners are rewarded with the cryptographic token underlying the network.

Proof-of-Work systems are decentralized, require a high amount of power to operate, and typically poorly scalable for widespread adoption by the general public.

Satoshi Nakamoto

Satoshi Nakamoto is the individual or pseudonym of the group responsible for creating the Bitcoin protocol. Nakamoto released the Bitcoin white paper in October 2008 and mined the first block on the Bitcoin network in January 2009.

About him, or them, nothing has been known since April 2011 when he posted a message on an online forum in which he said he "moved on to other things". Satoshi Nakamoto's identity is still surrounded by an aura of mystery and several unconfirmed theories claim to have revealed his identity.

Stablecoin

A stablecoin is a digital currency created for the sole purpose of maintaining a stable value over time and not being affected by the volatility of the cryptocurrency market. Most stablecoins tie their value to a predetermined fiat currency, having no significant fluctuations they are designed to be used rather than as an investment.

Staking

Staking is the process by which a user "bets" or blocks their cryptocurrency tokens in a network by participating in the consensus mechanism, thus ensuring the security and functionality of the blockchain. In order to encourage staking by users on a blockchain, most projects reward users with annualized financial returns.

Token

When we talk about tokens in a blockchain we refer to the unit of value for an asset that is managed by a smart contract and an underlying distributed ledger. These tokens, which can be fungible or non-fungible, are used to store value in a blockchain which is very often Ethereum. Initially, these tokens were used to manage simple transactions but in recent times more and more complex tokens are being designed that manage much more variable use cases for example for network governance and maintenance.

Wallet

A cryptocurrency wallet is a physical device (hardware), program, or online service that saves users' public and private keys, this allows them to perform transactions on various blockchains for the exchange, purchase, or sale of cryptographic assets. The wallet may or may not be connected to the internet, in this case, we are talking about a hot or cold wallet, it may or may not be guarded if it is guarded a trusted third party has control of a user's keys if it is not guarded only the user has his own private keys.

Whitepaper

A white paper is a technical document that is written by those who carry out a blockchain project or by a service that uses one, which describes the operating methodologies, the structure of the project, governance, the technology used, future developments, etc... It is often published in the early stages when looking for financiers to invest in the project and can subsequently be updated in case of progress or changes.

Conclusion

In this article, we have listed and described a series of basic terms necessary to properly approach the world of cryptocurrencies. There are many other interesting concepts to discover once you enter this world, but to take the first steps I think these are more than enough.

Bye, Alberto